Accelerated growth momentum in Q-2 likely to continue in the sector: FICCI Manufacturing Survey

Nov 12, 2023

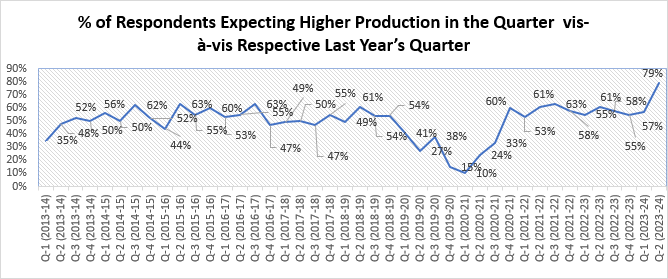

- 79% respondents reported higher production in Q-2 as compared to 57% in Q-1

- Survey reveals stable investment outlook to propel growth

NEW DELHI, 13 November 2023: FICCI’s latest quarterly survey on Manufacturing reveals that momentum of growth has accelerated in Quarter 2 of 2023-24 which is likely to continue for the subsequent quarters of FY 2023-24 as well, notwithstanding slowdown in developed nations. In the Q1 April-June 2023-24, 57% of the respondents reported higher production levels. Further, over 79% of the respondents shared higher level of production in Q2 July-September 2023-24. This assessment is also reflective in order books as 80% of the respondents in Q-2 July-September 2023-24 have had higher number of orders and demand conditions continue to be optimistic in Q-2 Jul-Sept 2023-24 as well.

FICCI’s latest quarterly survey assessed the performance and sentiments of manufacturers for Q-2 July-September (2023-24) for ten major sectors namely Automotive & Auto Components, Capital Goods & Construction Equipment, Cement, Chemicals Fertilizers and Pharmaceuticals, Electronics & White Goods, Machine Tools, Metal & Metal Products, Textiles, Apparels & Technical Textiles, Paper, and Miscellaneous. Responses have been drawn from over 380 manufacturing units from both the large and SME segments with a combined annual turnover of over Rs. 4.88 lakh crores.

Figure:1

Source: FICCI Survey

Capacity Addition & Utilization

- The existing average capacity utilization in manufacturing is around 74%, which reflects a sustained economic activity in the sector. This is slightly higher than 73% capacity utilization reported for previous quarters.

- The future investment outlook has also improved as compared to the previous quarter as over 57% of respondents reported plans for investments and expansions in the coming six months. This is also a slight improvement over the previous survey.

- In terms of major constraints, demand comes out to be the major constraint and limiting factor to realise the true potential of manufacturing sector in India, with over 40% respondents highlighting inadequate demand as a significant constraint. Whether it is domestic demand or exports, this remains a major limiting factor. Some other constraints, though not major ones, are high raw material prices, increased cost of finance, logistics, and other supply chain disruptions are some of the major constraints which are affecting expansion plans of the respondents. The table below gives average capacity utilization for various sub-sectors of manufacturing.

Table: Current Average Capacity Utilization Levels as Reported in Survey (%)

|

Sectors |

Average Capacity utilisation |

|

Automotive & Auto Components |

74 |

|

Capital Goods & Construction Equipment |

77 |

|

Cement |

80 |

|

Chemicals, Fertilizers & Petrochemicals |

68 |

|

Electronics & White Goods |

74 |

|

Machine Tools |

73 |

|

Metal & Metal Products |

78 |

|

Miscellaneous |

68 |

|

Paper & Paper Products |

90 |

|

Textiles, Apparels & Technical Textiles |

76 |

|

Grand Total |

74 |

Inventories

· 85% of the respondents had either more or the same level of inventory in Q-2 July-September 2023-24, which is almost equivalent to that of the previous quarter.

Exports

· On the export front, performance seems to be better than previous quarters as over 48% of the respondents reported higher exports in Q-2 July-September 2023-24 as compared to the 33% in Q-1 2023-24. However, further improvement in export demand is required in the light of country’s growth aspiration.

Hiring

- Hiring outlook looks stable with around 38% of the respondents looking at hiring additional workforce in the next three months.

Interest Rate

- 59% respondents reported that they have witnessed some marginal increase in the interest rates over the previous quarter.

Sectoral Growth

· Based on responses, Electronics & white Goods, Cement, Automotive and Machine tools have displayed strong growth and are clear outperformers.

· Whereas, sectors like Capital Goods & Construction Machinery, Chemicals, Textiles, Metals, Paper and other sectors have displayed moderate growth.

Table: Growth expectations for Q-2 FY 2023-24

|

Sector |

Growth Expectation |

|

Automotive & Automotive Components |

Strong |

|

Capital Goods & Construction Equipment |

Moderate |

|

Cement |

Moderately Strong |

|

Chemicals, Fertilizers & Pharmaceuticals |

Moderate |

|

Electronics & White Goods |

Strong |

|

Machine Tools |

Strong |

|

Metals & Metal Products |

Moderate |

|

Miscellaneous |

Moderate |

|

Textiles, Apparels &Technical Textiles |

Moderate |

|

Paper & Paper products |

Moderate |

Note: Very Strong >20%; Strong 10-20%; Moderate 5-10%; Low < 5%

Source: FICCI Survey

Production Cost

· There seems to be some moderation in the cost pressures on manufacturers in Q-2 July-September 2023-24. The cost of production as a percentage of sales for manufacturers in the survey has risen for 58% respondents as compared to 77% respondents for the previous quarter.

· Nonetheless, high raw material prices and high energy cost are the two main factors contributing to the high production costs.

Workforce Availability

· Most sectors have sufficient labor force engaged in their operations and are not facing shortage of labor at factories. While 82% of our respondents mentioned that they do not have any issues with workforce availability, the remaining 18% feel that there is still lack of skilled workforce available in their sector.